Send us an enquiry to obtain additional information about our GST Compliance Solution. We will analyze your enquiry and return to you shortly by email or phone.

GET YOUR SYSTEM COMPLIANT e-INVOICING INTERFACE

E-INVOICING: BUSTING THE MYTHS

e-invoicing or electronic reporting of sales invoices will soon be a reality. There are several myths and misconceptions about e-invoicing. It will be helpful to know some facts:

- e-invoicing is electronic reporting of the sales invoices to the GSTN through the Invoice Registration Portal (IRP). Invoices will not be generated on the IRP.

- e-invoice does not replace e-way bill. An e-way bill will be required for transport of goods. Data from e-invoice can be used to autopopulate e-way bills. There will still be some transactions which do not require e-invoice but e-way bill will be required

- e-invoice does not change the tax structures or computation, but the reporting only. Compliance is an IT exercise - not a tax consulting task.

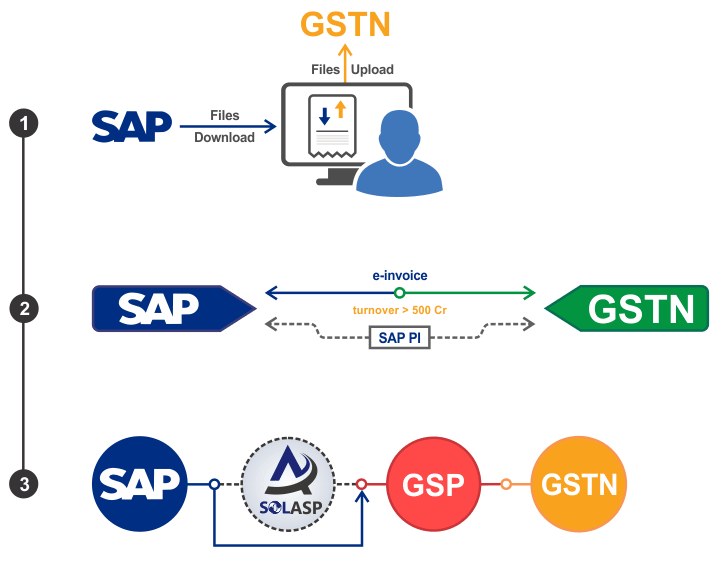

OUR SOLUTION

- Solsynch is a registered ASP aligned with one of the leading GSPs of India

- Solsynch has developed a cloud-based application to integrate the SAP system with the IRP

- SAP documents can be transmitted real time to the Solsynch portal with the highest security and encryptions.

- After validation, the data can be transmitted to the IRP.

- Registered invoice number along with the QR code and digital signature generated by the IRP can be transmitted back to the SAP system for further processing / printing.

ARE YOU READY FOR THE CHANGE?

- Unlike GST returns, e-invoicing is a real time transaction. It will be practically impossible or extremely cumbersome for companies to generate e-invoices in offline / manual mode.

- Integration with backend systems is practically mandatory for smooth operations.

THE SOLSYNCH ADVANTAGE

- Solsynch has been delivering solutions synchronized to our customers' business for several years now

- We have a team of experts who specialize not only on the technical aspects of SAP but also have a sound understanding of the taxation system in India.

- Solsynch already has a working portal for e-way bill generation and GST returns process.